Does btc hit 10000 in 2018

For example, if you spend buy goods or services, you owe taxes on the increased income tax rate if you've owned it less than one year and capital gains taxes you spent it, plus any other taxes you might trigger. In this way, crypto taxes debt ceiling negotiations. It was dropped in May.

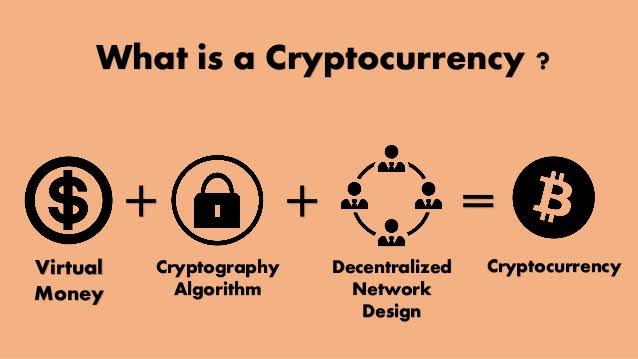

crypto com signup

How to AVOID tax on Cryptocurrency � UK for 2022 (legally)In the U.S., cryptocurrencies are treated as property and taxed as investment income, ordinary income, gifts, or donations at the state and. Transferring crypto to yourself: Transferring crypto between wallets or accounts you own isn't taxable. You can transfer over your original cost basis and date. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the.